2025 Loyalty Report

Is your brand tapping into these three unshakeable pillars of guest loyalty in 2025?

Comp Programs: Twice the cost when not properly handled

Complimentary (comp) programs entitle guests to receive products or special discounts at your restaurants. Whether used as a goodwill gesture for guests or to extend a privilege to employees, providing comps is a part of doing business.

Many restaurants manage their comp programs by issuing paper certificates as a quick, flexible, on-the-spot solution to a comp situation. However, these paper certificates are easy targets for fraud and abuse which can greatly increase the cost of a comp program.

Others opt to use gift cards as a means to comp guests. Like paper certificates, gift cards are readily recognized, convenient to issue, and easy for guests to redeem. Unfortunately, comp programs follow distinct financial accounting procedures. Failure to isolate comp transactions from standard gift card transactions creates a “double taxation” penalty that can overstate your sales tax and income tax burden by as much as 12%!

“If a guest had a bad meal, we used to reduce their bill with a free item on the spot. We switched our comps to specially marked gift cards, which eliminated a tremendous amount of fraud. However, this created a headache for accounting and we were never able to fully correct all of the tax issues. Paytronix allows us to use comp cards the way we had always intended, controlling the issuance and redemption by inserting a discount or comp into the check.”

VICE PRESIDENT, INFORMATION TECHNOLOGY, ELEPHANT BAR

![]()

Comps make ideal donations for charitable events like raffles, drawings, or auctions

Discounted or budgeted meal purchases can be offered to all or key employees

Comps can be used to reward stellar guests or compensate for poor experiences

Comps are an effective tool for promoting store openings or attracting new visitors

Instead of being paid with cash, people like your plumber or electrician can be given comps

Common pains of comp programs: Fraud and Control

Comps typically represent 3-5% of total sales — a meaningful slice of your business — yet they are often not well controlled or properly processed. The main risks of poorly administered comp programs include fraud and abuse, as well as improper financial accounting.

Fraud and Abuse - No One Wants to Lose Money

Inadequate measurement and control of comp programs can result in fraudulent behavior. Paytronix customers report that one in 10 controllable comp dollars is commonly lost to fraud. Paper certificates lack inherent controls and are particularly susceptible. Fraud is not limited to paper-based systems, though. A discount button on your POS system without appropriate controls also invites overuse and abuse.

Improper Financial Accounting = Increased Tax Burden

Improper processing of comp transactions can also cause you needless financial losses. Recording the value of comp transactions requires specific accounting treatment. When mishandled, you will fall victim to the “double taxation” penalty.

Fundamentally, this taxation penalty occurs because the comp value is a restaurant expense, not revenue. When you fail to appropriately recognize this expense, you artificially inflate your revenues, overstate your net income, and thereby overstate your income and sales tax liability. This overstating is a costly and unnecessary expense.

Gift Cards, the Common Offender

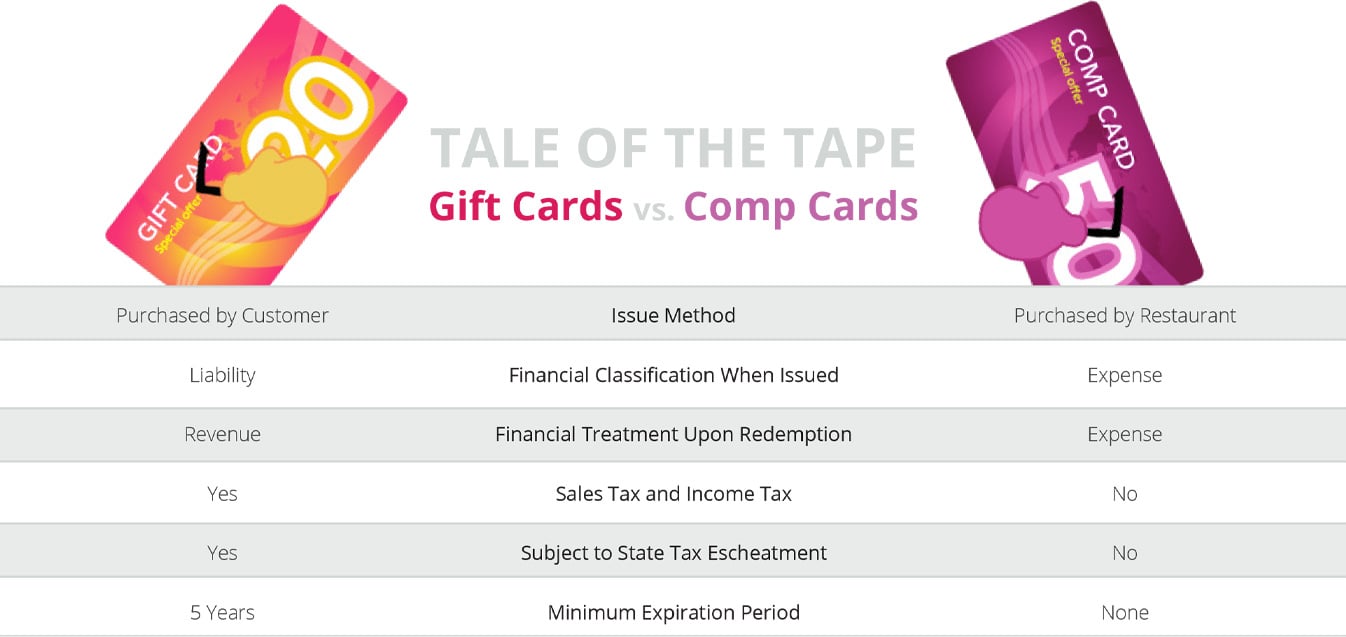

This taxation penalty often arises when comp situations are handled by issuing a gift card. A gift card is the wrong device for comp transactions. Comp cards and gift cards are both valuable elements in retaining and attracting guests. But, they are distinctly different instruments.

A gift card is sold to guests, represents taxable revenue, and appears on the balance sheet as an accounting liability until redemption.

The value on a comp card is recognized as an accounting expense. A comp should appear as a discount that lowers the subtotal of a guest’s check and reduces the amount of tax associated with the transaction. The comp is given to a guest – not sold – and therefore should be reflected as a business expense, not as revenue.

Consequences of Mixing Gift and Comp Cards

Companies not working with Paytronix have sometimes had to restate earnings to correct for improper comp treatment. This is because they could not differentiate their comp and gift card balances and were forced by auditors to expense 25% of the combined outstanding balance.

Many chains try to backout the comp transactions in their general ledger, but it is difficult to differentiate these transactions and to accurately account for the amount of comps extended. For example, some companies require that receipts be mailed to corporate for processing. This is a labor-intensive process where lost and unidentified receipts understate the true comp amounts.

Plus, you cannot back out the sales tax. States generally conduct audits based on POS reports, not general ledger data. Assigning proper tax rates gets very complex when a check has different items with different tax rates and is paid with comp and other tenders.

“Biaggi’s constantly receives requests for various types of comps. Managing these requests and keeping to budget was a real challenge. Paytronix has provided us with a platform that allows us to track comp usages and activations by type, location, manager, and server. This level of control has enabled us to feel confident with our comp card program. It has made a big difference to our senior management team and the finance staff. We even use the Paytronix reports as one of our internal performance measures.”

Paytronix offers secure, accurate comp solutions

Paytronix provides integrated solutions to guard against fraud and accurately handle the accounting complexities of your comp programs. The Paytronix reporting system also gives you detailed information about who is issuing comps and for what purpose allowing you to actively manage your comp programs.

The Paytronix comp card solutions lead the industry. We know that fraud and mishandled comp programs cost you money, so our comp cards provide you with a safe, practical way to offer complimentary value to guests while halting fraud and assuring proper accounting for every comp transaction.

How Paytronix Handles Comp Cards

Like gift cards, comp cards hold a specific dollar value. Since they are given to guests – not sold – they must be accounted for differently at both issuance and redemption. Our systems ensure that this tracking is done accurately and without manual intervention.

We ease your administrative burden by facilitating effective execution at the point of sale. Paytronix understands the accounting intricacies, and our systems have been designed to handle these complexities.

Accurately Manage Comp Redemptions for Your Guests and Your Business

When redeemed, the comp value appears as a discount and reduces the check subtotal prior to payment. This ensures that your guests recognize the benefits and you can accurately account for revenue recognition and sales tax liability.

Differentiating Comp Cards from Gift Cards

Comp cards and gift cards hold different value for your business and require different accounting treatment. Paytronix solutions enable you to separate these different programs and manage each appropriately.

Tracking and Controlling Your Comp Programs

Powerful reporting capabilities make it easy to track and understand your comp programs. Armed with knowledge of comp card issuance and redemption details, you can make adjustments to ensure that the administration of your programs aligns with your policies and objectives.

Providing Flexibility to Meet Your Needs

Comp programs are one component of the total Paytronix solution. We can create comp card solutions as part of a comprehensive loyalty program designed specifically to achieve your objectives.

A well-executed comp card program provides a secure, convenient method for offering your guests valuable discounts. To learn more about improving your comp programs, contact us.

“We used gift cards as comp cards for a long time with another provider. Paytronix has the only solution we could find that allowed us to treat a comp card as a discount at the POS. Switching to Paytronix has solved an accounting headache for us and improved the tax treatment of comp cards.”