What are the Average Restaurant Sales per Month by Category?

Breaking down average restaurant sales per month gives restaurant owners, managers, and investors a clearer view of how the business is performing....

Platform

Combining online ordering, loyalty, omnichannel messaging, AI insights, and payments in one platform. Paytronix delivers relevant, personal experiences, at scale, that help improve your entire digital marketing funnel by creating amazing frictionless experiences.

A Complete Customer Experience Platform

Online Ordering

Acquire new customers and capture valuable data with industry leading customization features.

Loyalty

Encourage more visits and higher spend with personalized promotions based on individual activity and preferences.

Catering

Grow your revenue, streamline operations, and expand your audience with a suite of catering tools.

CRM

Build great customer relationships with relevant personal omnichannel campaigns delivered at scale.

Artificial Intelligence

Leverage the most data from the most customer transactions to power 1:1 marketing campaigns and drive revenue.

Payments

Drive brand engagement by providing fast, frictionless guest payments.

Solutions

We use data, customer experience expertise, and technology to solve everyday restaurant and convenience store challenges.

Contactless Experiences

Accommodate your guests' changing preferences by providing safe, efficient service whether dining-in or taking out.

Customer Insights

Collect guest data and analyze behaviors to develop powerful targeted campaigns that produce amazing results.

Marketing Automation

Create and test campaigns across channels and segments to drive loyalty, incremental visits, and additional revenue.

Mobile Experiences

Provide convenient access to your brand, menus and loyalty program to drive retention with a branded or custom app.

Subscriptions

Create a frictionless, fun way to reward your most loyal customers for frequent visits and purchases while normalizing revenues.

Employee Dining

Attract and retain your employees with dollar value or percentage-based incentives and tiered benefits.

Order Experience Builder

Create powerful interactive, and appealing online menus that attract and acquire new customers simply and easily.

Loyalty Programs

High-impact customizable programs that increase spend, visit, and engagement with your brand.

Online Ordering

Maximize first-party digital sales with an exceptional guest experience.

Integrations

Launch your programs with more than 450 existing integrations.

Loyalty Programs

Deliver the same care you do in person with all your digital engagements.

Online Ordering

Drive more first-party orders and make it easy for your crew.

Loyalty Programs

Digital transformations start here - get to know your guests.

Online Ordering

Add a whole new sales channel to grow your business - digital ordering is in your future.

Integrations

We work with your environment - check it out.

Company

We are here to help clients build their businesses by delivering amazing experiences for their guests.

Meet The Team

Our exceptional customer engagement innovations are delivered by a team of extraordinary people.

News/Press

A collection of press and media about our innovations, customers, and people.

Events

A schedule of upcoming tradeshows, conferences, and events that we will participate in.

Careers

Support

Paytronix Login

Order & Delivery Login

Resources

Learn how to create great customer experiences with our free eBooks, webinars, articles, case studies, and customer interviews.

FlightPaths are structured Paytronix software onboarding journeys designed to simplify implementation and deliver maximum ROI.

See Our Product In Action

E-Books

Learn more about topics important to the restaurant and c-store customer experience.

Reports

See how your brand stacks up against industry benchmarks, analysis, and research.

Blog

Catch up with our team of in-house experts for quick articles to help your business.

Case Studies

Learn how brands have used the Paytronix platform to increase revenue and engage with guests.

Is your brand tapping into these three unshakeable pillars of guest loyalty in 2025?

8 min read

Aug 18, 2016

In case you missed it, there was a common theme among publicly held restaurant chains’ July earnings calls: Loyalty Programs. Multiple brand leaders spent a portion of their calls celebrating their loyalty programs, unequivocally stating that the programs are indeed impacting the value of the respective organizations, and that the programs are providing a competitive advantage.

Even Chipotle, a brand that has been a notorious, non-believer in loyalty programs, noted the value in the data they received from their short-term visit challenge promotion, Chiptopia. The promotion resembles the tip of the spear for a longer-term program. Below is a recap of the notable loyalty program mentions. But first, here’s an executive summary of the highlights:

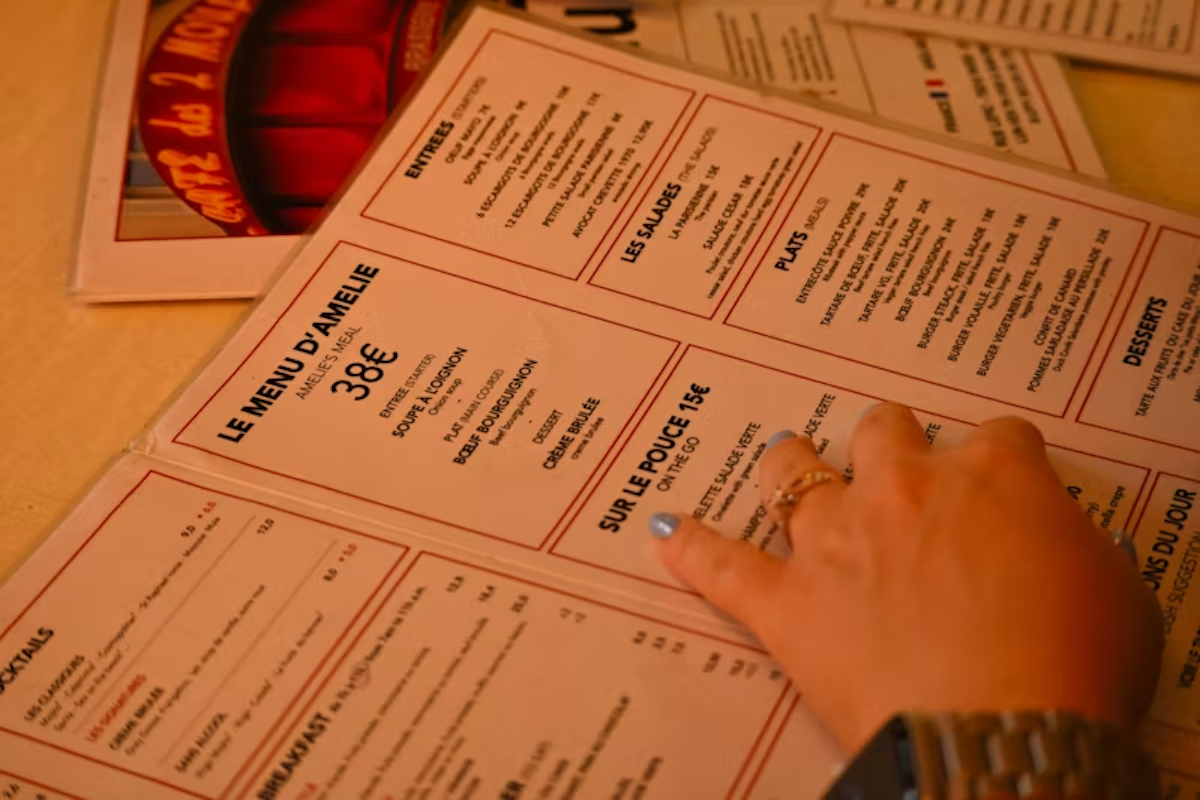

Image Source: CNBC Interview with Ron Schaich

Bloomin’ Brands spoke about loyalty in its July 29, 2016 earnings call, praising the early success of its newly introduced Dine Rewards program. Bloomin’ Brands launched Dine Rewards as its first multi-brand loyalty program on July 19, and CEO Liz Smith spoke to the early success of the program, noting, “It has already received high marks for its simplicity and value relative to peer programs. Guests also appreciate the ability to enjoy the benefits across our portfolio of brands.”

Smith continued to say the program has been in test since 2013, proving to be an effective means to drive frequency and increase sales. “When it reaches maturity, we expect Dine Rewards to drive a 1% to 2% lift in sales consistent with what we have received in six test markets,” said Smith. “The program was just launched nationally 2 weeks ago and we now have over 800,000 members enrolled.”

Dominos also addressed its guest loyalty program in the Company’s Q2 2016 Results Earnings Call on July 21, noting that the digital loyalty program had a meaningful positive impact in the second quarter. Dominos’ early objectives around simplicity and frequency are being met, and the Earnings Call noted that the program is meeting the high expectations Dominos had upon its launch.

CEO Patrick Doyle elaborated in his earnings call on July 31, explaining, “We designed our program to be about frequency to drive order counts and clearly we’re feeling very good about that. But one of the things we’ve talked about before and I think are particularly proud of and believe has been a big part of our success is that we do a lot of things in a lot of different parts of the world. We have big master franchisees who are all working on the same issues that we are in the U.S., and so when somebody figures something out somewhere there is very quick best practice sharing around the world. And clearly we’re happy with loyalty, clearly we’re sharing results, and then markets will make decisions on whether they’re going to launch it. And if they do, when they’re going to launch it, based on kind of the priorities and the list of new initiatives that they want to take in their market and kind of how they’re going to prioritize those. But absolutely the success that we’re having has been well noted within our system, and it’s certainly something that international markets are going to look at.”

“What I would say, has changed on loyalty in the second quarter versus the first quarter is simply the amount of time that we’ve been able to watch the results, analyze the data coming in. We already talked about in the first quarter that we were seeing good results from loyalty and we’re ready to say that, yes, it’s a success,” added Doyle in the Dominos earnings call. “A quarter later, we’re just that much more confident that it is absolutely doing what we expected that it was going to do.”

Doyle noted that for people to join the Dominos loyalty program, all they got to do is click a box. “The ease with which people can sign up for our loyalty program is clearly been part of the strength and Dominos ability to drive penetration in that program has been part of the strength of the results. It’s very much within the range of what our team predicted it to be and that number was predicted to be pretty high based on what we thought was a very attractive program.”

Dominos CFO Jeff Lawrence also spoke to the impact of loyalty in the call, saying, “All of this outstanding brand momentum helped us grow diluted EPS by 21% over the prior year quarter. Our recently launched loyalty program contributed significantly to our traffic gains.”

Starbucks spoke to the impact of loyalty in its July 21 earnings call as well, addressing Q3 2016 Results. Chairman & Chief Executive Officer Howard Schultz, said “In Starbucks’ 24 years of public life, I can’t recall a quarter quite like Q3 of 2016, when a confluence of social and political turmoil at home, weakening consumer confidence, increasing global uncertainty, and the launch of one of our most significant long term initiatives of all time all occurred within a single earnings period.”

Schultz also noted, “I want to address right out of the gate the two questions you’re likely asking yourselves. Does a 4% positive same store sales comp from our U.S. business in Q3 signify or even suggest a turning point in Starbucks’ long term growth trajectory? And does this comp figure in any way relate to the success and value of our Starbucks Rewards loyalty program?”

Schultz went on to explain why U.S. comps in Q3 were an anomaly, and Starbucks has a clear line of sight to returning business to historic levels of comp growth, which has been at or above 5% for the past 25 consecutive quarters. “We will demonstrate how the Starbucks Rewards program has been strengthened in Q3 and how the improvements will fuel an even more powerful digital flywheel that will propel our business forward for years to come,” said Schultz.

Howard Schultz spoke specifically to the impact that changing their loyalty program had during the quarter, acknowledging that, “in certain areas, Starbucks did not execute as well as we could have in the U.S. in Q3. Had we done so, we certainly would have reported stronger U.S. comps.” Schultz later added, “Very early in the quarter, and after months of planning, we began executing against what I am convinced will prove to be among our boldest and most strategic moves ever, the strategic shift of our tremendously successful loyalty program from a frequency-based to a spend-based model. The shift was a one time event, a once in a decade change built on carefully vetted analysis that showed that a spend-based program would best reward our most loyal customers and encourage all of our customers to visit us more often and spend more on each visit, and it would be more fair for all of our customers as well.” Schultz spoke to how Starbucks make the loyalty program change to eliminate a vexing in-store operating issue, order splitting. The change has resulted in shorter lines, increased speed of service, and reduced line attrition.

“Our loyalty program is the cornerstone of our digital flywheel,” continued Schultz, noting that the program now has over 19 million Starbucks Reward members, with over 10 million in China alone.

Chipotle Mexican Grill spoke to the impact that its new loyalty program is having as well, its Q2 2016 Results Earnings Call on July 22, 2016. Chief Financial Officer John Hartung spoke to the impact Chipotle had seen already after less than three weeks since launching their new Chiptopia loyalty program, “Every single day, we have over 100,000 people that are added to the program. The majority of them are registered in the program. And we’ve seen significant repeat visits.”

“We’ve seen like 28% of the people that are enrolled, they’re engaged in Chiptopia, have come back a second time. So we’re seeing saying exactly the results we had hoped that our already loyal customers who had reduced their visits after the results of – or after the events of last year are coming in more often.”

Hartung noted the loyalty program gives an incentive for people to come back more often as the months close, because each month account towards earning the big end of program awards. And so achieving a level in July is the starting point, then it starts over. “Basically, now you need to achieve that same level in August and then September,” said Hartung.

Digging into the loyalty program data, Chipotle Chairman and Co-CEO Steve Ells also said, “The single biggest thing we’re doing is we can now match up specific customer behavior using credit card data and people’s enrollment in Chiptopia and we’ve been able to go back–so far, we’ve gone back to June but we’re going to go back to even a year ago before all these events happened–to see the loyalty of our customers. We’ve got lots of outside data showing us what’s happened to the loyalty of our customers. So we’re going to be able to do a better job of seeing those customers that were once loyal a year ago, they were coming twice a week or three times or four times a week and have dropped their visits now to once or twice a week, we’re going to be able to see whether Chiptopia is bringing them back up to the two or three or four times a week that they visit.”

Ells noted that Chipotle has one that with the loyalty program data going from June to July, and they were very encouraged and shared that data on the Earnings call. “We also now have greater engagement with a lot of the customers where we can actually reach out and market to them. And so we have a communication link that we have with our customers as well.”

Ells then asked Mark Shambura, director of Chipotle’s Brand Marketing, to comment on the loyalty data. “We used the data and the regression analysis to really hypertarget those who had descended in their frequency or those who had lapsed to make sure we could invite all of those people into the program. And now, we can match up those who are now in the program to determine what their return frequency level is and utilize all of that data we’re mining there to help influence the evergreen loyalty program we are currently evaluating in the months to come,” said Shambura.

In the Panera Bread Results Earnings Call on July 27, 2016, President Andrew Madsen said, “Let’s talk about loyalty. Our MyPanera loyalty program now sits at 23 million members that represent nearly 50% of our transactions and the program is growing. In addition, MyPanera users are very loyal with double the visit frequency of our nonmember customers. We believe this is by far the largest loyalty program in the industry and a significant competitive advantage.”

Explaining the competitive advantage, Madsen continued to say, “There are three fundamental ways we leverage MyPanera. First, we utilize broadly appealing initiatives like Bagel Club, where targeted MyPanera members can receive a free bagel for a limited period when they visit a Panera Cafe to help drive profitable incremental transactions. We’ve made significant progress over the last year refining who receives these offers and when they receive them to ensure the maximum incremental lift and profitable transaction growth. The second way we use MyPanera program is to drive awareness and adoption of our new customer-focused initiatives like RPU, delivery, new seasonal product introductions and new cafe grand openings. By understanding our customers’ behaviors and preferences, we’re able to send our customers communications about relevant services and relevant products that make their daily lives better. The third way and most recent way we leverage MyPanera is microtargeting that helps drive stickiness for the brand.”

Madsen explained that Panera focuses on what they call ‘moments that matter’ to customers, with more personalized communications to the right person at the right time. “For instance, the day we introduced our new sandwiches, we will let past purchasers of our current Italian combo know that we have a new and exciting sandwich we think they’ll love, called ‘The Italian.’ And once we see that they purchased this new sandwich, we will immediately send them a second communication to reinforce their decision and provide them with additional information about the key benefits of this sandwich so that they’re more informed about their decision and better positioned to become an advocate of our brand to a friend. And we’ve experienced open rates that are more than 50% higher than our norm with this more personalized approach.”

“All of these MyPanera efforts are in service of our moving to a more one-to-one marketing approach, sending the right message and the right medium to the right customer at the right time. So, let me close by saying that we’re very excited about our innovations to date and even more excited about those to come.”

See Ron Schaich, CEO of Panera, in an interview with CNBC discussing the recent earnings. https://youtu.be/CcPxhmlzg5g

As the nation’s most influential and innovative brands continue to the get to know their guests, the pressure will rise on competitors clamoring for market share to do the same. In order to gain long-term stability that will carry a chain through tough economic climates or unchartered service or quality issues – brands need to know who their guests are and how to reach each one of them. Consider Chipotle’s new point of view, “…We also now have greater engagement with a lot of the customers where we can actually reach out and market to them…” shared Steve Ells, Chipotle Chairman and Co-CEO.

Breaking down average restaurant sales per month gives restaurant owners, managers, and investors a clearer view of how the business is performing....

Understanding the cost of goods sold (COGS) is crucial for maintaining healthy profit margins in both restaurants and convenience stores (c-stores)....

Menu engineering is a proven strategy to increase restaurant profitability. By analyzing sales data, you can refine your offerings to focus on...